Mini-job contract: what should you pay attention to?

For many of us, university is also the stage of having a mini-job, the complementary activity that for a few hours a week allows us to have those 520 euros key for survival.

Are you facing that first or new mini-job and have no idea what your employment contract should look like? Don’t worry! Here’s an ally against the occasional complications of bureaucracy. I’ve made a list of the most important aspects you should look at. Of course every contract and company/employer is different, but there are some basics that should never be missed.

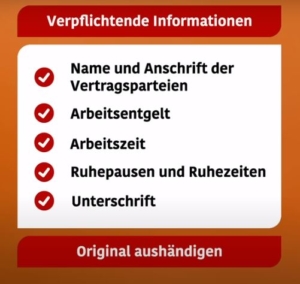

A contract ensures clarity in the employment relationship and protection for both mini-jobbers and employers. It contains the rights and obligations for both sides. With that in mind, what points should definitely be included?

- Name and address of the employee and the employer + workplace

- Arbeitszeiten – working hours, rest periods and breaks (important! Normally you have them after 6 working hours per day but it depends on the activity)

- Stundenlohn – composition of the salary (including remuneration for overtime, surcharges, allowances, bonuses and special payments), as well as the due date and type of payment.

- Start + End or expected duration of the mini-job

- Duration of the probationary period

- Type of activity and claims for training

- Urlaubstage – holiday entitlement, length of annual vacation leave

- Notice periods and intended form of termination

- Reference to applicable collective agreements, company or service agreements

- Name and address of the pension provider in case of company pension schemes

- On-call work conditions

- The possibility of working overtime

Contract basics. Source: Mini-job Zentrale, 2023.

Deadlines

The mini-jobber needs written proof (signed and handed over in original) on the first working day at the latest of the first three points. The written proof of points 4-6, 11 and 12 should be given no later than on the seventh day after the agreed start of work. All other information must be provided after one month at the latest.

Verbal and written

Although you should always prefer a written contract, note that a verbal agreement is also possible for mini-jobs. But even in this case, the employer must provide a printed and signed written proof of the essential working conditions for the mini-jobber no later than one month after the start of the mini-job. The proof must contain the following at least the first 9 points mentioned above.

Other interesting regulations

The new statutory minimum wage of 12 euros per hour has been in effect since October 1, 2022. The maximum annual income is therefore 6,240 euros. If you earn more than that, your activity will be subject to social security contributions.

In unplanned exceptional cases —for example when covering sickness— mini-jobbers may exceed the annual income limit without being subject to contributions. The following applies here: The limit may be exceeded unforeseeably only in two months within a year. In the months of unplanned exceeding, earnings may not exceed twice the monthly earnings limit, i.e. 1,040 euros per month.

If you’re interested in the formulation of the individual points, you can check two sample contracts for mini-jobs here: Muster für das Gewerbe and für den Privathaushalt.

I hope this article helped to reflect on your own experience with employment contracts. Feel free to share with us.

Hello,

Work Baby work! Make money$